Which Are Indicators That Economists Use?

Welcome to our latest blog post where we dive deep into the world of economics and unravel the mystery behind those fascinating indicators that economists use. Have you ever wondered how experts predict economic trends or assess the health of a nation’s economy?

Well, wonder no more! In this article, we will take you on an enlightening journey through some of the most important indicators that economists rely on to make informed decisions and predictions.

Whether you’re an aspiring economist or simply curious about what drives our global financial system, get ready to be captivated by the hidden gems that shape our economic landscapes. So sit back, grab your thinking cap, and let’s explore together which indicators truly hold the key to understanding economies.

Table of Contents

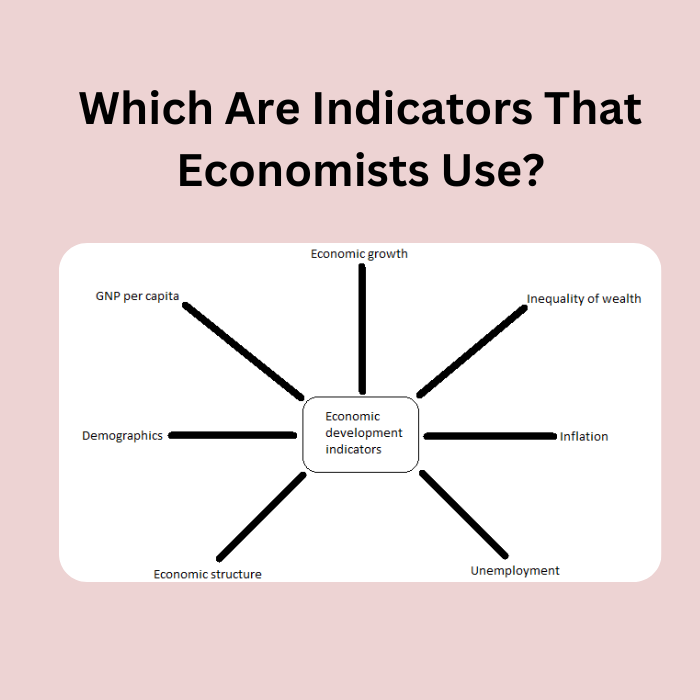

Indicators that economists use?

Indicators that economists use to measure economic activity include Gross Domestic Product (GDP), unemployment rates, inflation rates, and consumer confidence indexes. GDP is a good indicator of the overall health of the economy because it measures the value of all domestic production.

Unemployment rates provide insight into how many people are looking for work and are therefore out of a job. Inflation rates show how much prices are rising over a period of time, and consumers’ confidence indexes indicate how confident people are about their ability to purchase goods and services.

Types of indicators

There are a variety of different indicators that economists use to measure the state of the economy. Some of these indicators include gross domestic product (GDP), employment, inflation, and interest rates:

- Gross Domestic Product (GDP) is one of the most common indicators used by economists. GDP measures the total value of all goods and services produced in a country over a given period of time. GDP is often used to track economic growth and changes in the overall health of a country’s economy.

- Employment is another important indicator that economists use. Employment measures the number of people who are working in an economy compared to the number of people who would be working if there were no unemployment or underemployment issues present. Employment levels can be used to predict future economic trends and movements.

- Inflation is also an important indicator that economists use. Inflation measures the rate at which prices are increasing over a certain period of time. Economists use inflation rates to predict future consumer price increases and determine whether or not it is necessary for the country’s Central Bank to increase interest rates in order to maintain stable prices.

- Interest rates are also an important indicator that economists use. Interest rates indicate how much money investors are willing to pay for debt securities (such as government bonds) with varying terms (such as short-term, intermediate-term, and long-term). Changes in interest rates can have a significant impact on investment decisions and economic growth.

Description of each indicator

The following are descriptions of each indicator economists use:

- GDP: Gross Domestic Product is a measure of the value of all final goods and services produced within a country in a given period. GDP can be calculated by subtracting the cost of goods and services purchased by domestic residents from the value of exported goods and services.

- Inflation: Inflation is a sustained increase in the prices of goods and services in an economy over time. The most common measure of inflation is the Consumer Price Index (CPI), which tracks prices across a range of consumer goods and services.

- Unemployment Rate: The unemployment rate is the percentage of people who are unemployed, as measured by the labor force participation rate. The labor force participation rate is the share of adults in the population who are either employed or looking for employment.

How do economists use indicators?

Economists use a variety of indicators to measure different aspects of the economy. Some common indicators include economic growth, unemployment rates, inflation rates, and stock market prices.

The most important aspect of using indicators is making sure that the data used is accurate and up to date. If an economist uses an indicator that is no longer accurate or not up to date, it could lead to inaccurate conclusions about the state of the economy. Additionally, if an economist uses an incorrect indicator, it could lead to incorrect policy decisions being made.

It is important for economists to use a variety of indicators in order to get a full picture of the economy. By using multiple indicators, economists can ensure that they are getting accurate information about the state of the economy and making informed decisions about policy changes.

Conclusion

In conclusion, indicators are important tools that economists use to measure and track the state of the economy. Knowing which indicators to look for can help you stay informed about what is happening in the market and how it might impact your personal finances.