What Categories Should Be In A Budget?

Are you tired of feeling like your money is slipping through your fingers, without any clear plan or direction? Well, fear not! We’re here to help you take control of your finances by delving into the world of budgeting. And one crucial element that often gets overlooked is determining what categories should be in a budget.

That’s why today, we’ll be discussing the absolute must-have categories that should be part of every successful budget. So whether you’re a seasoned pro looking to revamp your financial strategy or a newcomer eager to learn the ropes, stick around and discover how these essential categories can pave the way toward financial freedom.

Budgeting is an important part of personal finance. Knowing how to create a budget can help you save money and improve your financial situation. There are many different ways to create budgets, but some common categories are spending, income, and debt.

- Spending: This category includes all your regular expenses, like groceries, bills, entertainment, etc. You should try to keep this category at or below your monthly income.

- Income: This category includes all the money you earn from your job or other sources. You should try to keep this category at or above your monthly spending.

- Debt: This category includes any loans you have taken out or any debts you have incurred in the past. You should try to keep this category below your total annual income.

Table of Contents

What is a Budget?

A budget is a plan for spending your money. It helps you stay within your means and avoid overspending. There are many different types of budgets, but the most common one is the monthly budget.

To create a monthly budget, start by charting out your expenses for the past month. This will help you to see where your money goes and how much you can afford to spend each month.

Next, decide which categories should be in your budget: groceries, rent, bills, etc. Once you have a list of categories, figure out how much money each one should cost. Put everything together and write down what you spent in each category every month.

How to Make a Budget?

Making a budget is an essential part of any financial planning process. It can be challenging to figure out exactly what items to include in your budget, but by following these guidelines you can create a realistic plan that Reflects Your Financial Profile and Allows for Proper Spending.

There are many different ways to make a budget, but the most important thing is to start with a list of your expenses and income. This will help you figure out where your money is going and help you create categories for your budget.

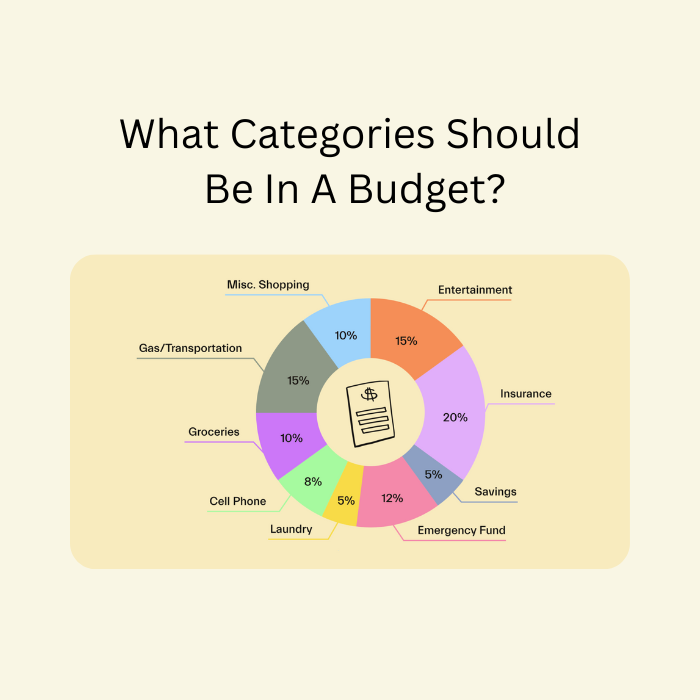

Some common categories for a budget include Income, Bills, Expenses, Savings, Debt Reduction, and Retirement Planning. You may also want to consider creating specific budgets for things like groceries, housing costs, car payments, and childcare expenses.

Once you have created your categories and sorted your expenses accordingly, it’s time to come up with a spending limit for each category. This limit should be based on how much money you realistically expect to spend in that category over the course of the month or year.

If you don’t have enough money saved up in one particular category to cover your monthly spending limit, then you’ll need to find ways to save more money overall or reduce other monthly expenses.

Budgeting is an important part of financial planning; by following these guidelines you can create a plan that Reflects Your Financial Profile and Allows for Proper Spending.

Categories to Include in a Budget

There are many different types of budgets, but a general budget should include the following categories: income, expenses, savings, and debt. Allocating money in each category can help you make informed financial decisions and keep your finances on track.

- Income: This includes all sources of income, such as salary, wages, tips, commissions, rental income, and government benefits.

- Expenses: This includes everything you spend money on regularly, such as groceries, electricity bills, car payments, and mortgage payments.

- Savings: This is where you put aside money to cover unexpected costs or long-term investments.

- Debt: This includes both household and credit card debt. When planning your budget, be sure to take into account both your current and future debts.

Conclusion

In today’s economy, it is more important than ever to be mindful of your spending. While there are many factors to consider when creating a budget, some key categories should always be included: housing, transportation, food and beverage, and healthcare.

By following these rules, you can create a budget that will allow you to live comfortably while still saving money on essential expenses.