How Much For Emergency Fund?

Picture this: your car breaks down unexpectedly, your roof springs a leak during a storm, or worse yet, you suddenly find yourself facing an unforeseen medical emergency. Life has a funny way of throwing curveballs when we least expect them.

That’s why having an emergency fund is not just a good idea—it’s absolutely crucial. But the question remains: how much should you have stashed away in case of life’s unexpected moments? In this blog post, we’re breaking it all down to help you build the perfect safety net and give you peace of mind when disaster strikes.

Table of Contents

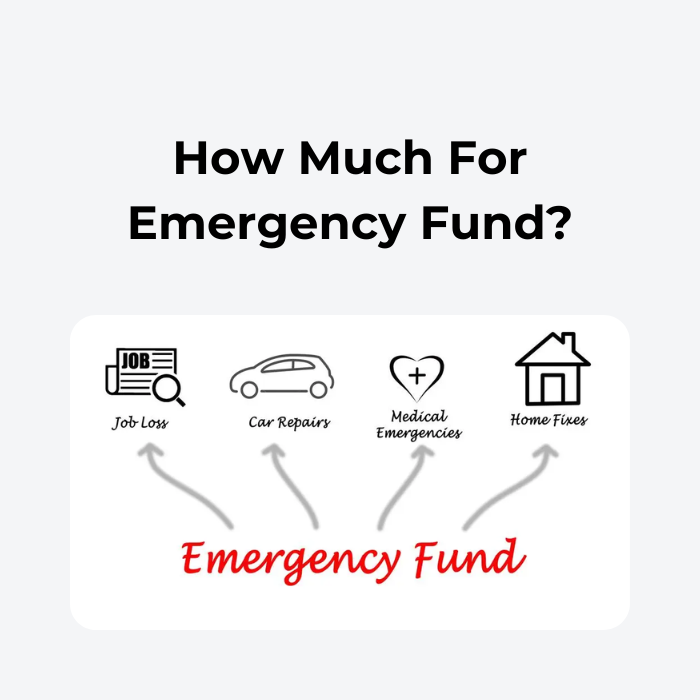

What is an emergency fund?

An emergency fund is a savings account that you set up to cover unexpected expenses, such as a car repair or a costly hospital stay. You should aim to have at least three months’ worth of expenses saved up in your emergency fund.

If something unexpected happens and you don’t have enough money saved up in your emergency fund, you may need to take out a loan or borrow money from friends or family. Be sure to keep track of how much money you’re spending each month so you can calculate how much money you need to save each month in order to reach your goal.

Keep in mind that an emergency fund is not just for financial emergencies; it can also be used to cover small costs, like replacing broken appliances or fixing a leaky roof. The more options you have for covering small costs, the less likely you are to resort to borrowing money from lenders or pawn shops.

Types of emergency funds

There are a few different types of emergency funds that you can create:

- Savings account: This is the most common type of emergency fund. You should aim to have at least three months’ worth of living expenses saved in a savings account.

- Certificate of deposit: A certificate of deposit is a great way to save for an emergency fund because it offers stability and safety. You can find certificates of deposit with high-interest rates, which means you will be able to save more money over time.

- Stock market: If you’re looking for a more volatile way to save for an emergency fund, investing in the stock market may be the best option for you. However, be sure to do your research first so that you don’t end up losing all your money in a crash.

- Brokerage account: A brokerage account allows you to invest money in stocks, bonds, and other securities without having to own them yourself. This type of account comes with fees, but it can offer better returns than saving directly in the stock market or a traditional savings account.

The minimum amount you need for an emergency fund

An emergency fund is important for any person or family. You never know when a financial emergency will arise, and having an emergency fund can help you get through it. The amount of money you need for an emergency fund depends on your individual situation.

However, the minimum amount you need is typically equal to three months’ worth of expenses. So, if you anticipate needing $6,000 in total for emergencies over the next three months, your emergency fund should have at least $18,000 in assets.

You can create your own budget and figure out how much money you need to save each month to reach your goal. Once you know how much money you need to save each month, start putting that money away in a savings account or another investment vehicle that provides stability. If possible, try to keep your Emergency Fund invested in low-risk assets so that it will provide insurance against unexpected financial setbacks.

How to set up an emergency fund?

The emergency fund should be an account you have saved up in case of a financial emergency. There are a few things you need to think about when setting up your emergency fund: how much money you want to put aside, what type of account is best for you, and how often you will access the funds.

It’s important to determine how much money you want to save as your emergency fund. The amount can vary based on your unique situation but aim to have at least 3-6 months’ worth of expenses saved. Some people prefer to set aside a larger sum of money (10-15% of their annual income), while others might opt for a smaller amount (1-3 months’ worth of expenses).

It’s also important to decide which type of account is best for your needs. A savings account with low-interest rates is usually preferred over a high-yield IRA or 401k because it offers more flexibility in accessing the funds.

Once you’ve determined the amount and type of account you’d like to use for your emergency fund, it’s time to figure out how often you’ll access the funds. This can be tricky since different situations could require different levels of access. A good rule of thumb is to make sure that at least one month’s worth of expenses is always accessible without penalty.

Pros and Cons of having an emergency fund

There are pros and cons to having an emergency fund. The main advantage is that you can use it for unexpected expenses, such as car repair or medical bills.

The downside is that if you need to access your fund quickly, you may have to sell assets to get the money you need. You should also consider whether an emergency fund is right for you. Some people find that they don’t need one because they’re never out of money. Others may want to have enough money to cover three months of expenses.

Conclusion

In today’s economy, things can change quickly. That means that your emergency fund may not be enough to cover unexpected expenses if they occur. It is important to have at least three months of living expenses saved up so that you are prepared for any emergencies that come up.

Determine an amount that you can comfortably live without and make sure you transfer this money into a savings account or an emergency fund every month. This way, you will always be ready for whatever comes your way.