How To Get Ahead Financially?

Are you tired of constantly feeling like your finances are holding you back? Do you dream of a life where money is no longer a limitation but instead a tool to help you achieve your goals and dreams? Well, look no further! In this blog post, we will unveil the secrets to getting ahead financially.

Whether you’re just starting out on your financial journey or hoping to take it to the next level, we have all the tips, tricks, and strategies that will set you up for success. Get ready to transform your financial future and pave the way toward ultimate freedom.

Table of Contents

Understanding Financial Goals

When it comes to financial success, having clear and attainable goals is crucial. Without a plan, it can be difficult to make progress and reach your targets.

There are a few different factors to consider when setting financial goals. First, think about your current situation and where you want to be in the future. What do you need to do to get there?

Next, consider your short-term and long-term goals. Short-term goals might include paying off debt or saving for a down payment on a house. Long-term goals could include retirement planning or sending your kids to college.

It’s also important to think about your risk tolerance when setting financial goals. Some people are more comfortable taking risks than others. If you’re risk-averse, you might want to focus on building up your emergency fund or saving for retirement. If you’re willing to take more risks, you might invest in stocks or real estate.

No matter what your financial goals are, remember to be realistic and patient. It takes time and effort to achieve most things in life, including financial success. Don’t get discouraged if you have setbacks along the way. Just keep working towards your goals and eventually, you’ll reach them.

Creating a Budget

Assuming you don’t have a financial windfall coming your way, the best way to get ahead financially is to create and stick to a budget. This may seem like an obvious solution, but it’s one that many people struggle with. Creating a budget doesn’t have to be complicated or time-consuming. The key is to find a system that works for you and then stick to it.

There are a few different ways to approach budgeting:

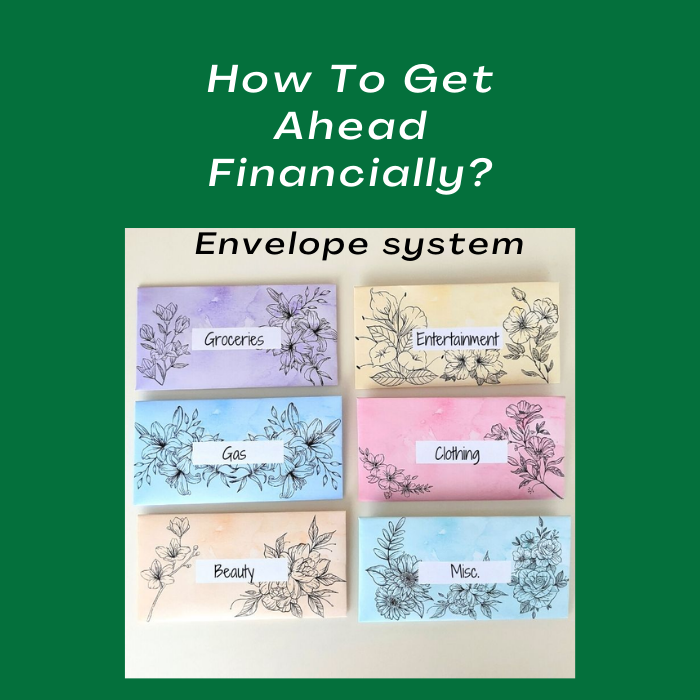

- One popular method is the envelope system, where you allocate a certain amount of money for each spending category and put the cash in labeled envelopes. This helps you stay mindful of your spending and keeps you from overspending in any one area.

- Another option is to track your spending using software or apps like Mint or YNAB (You Need a Budget). This can be helpful if you prefer to see your finances laid out in numbers.

Whichever method you choose, the most important thing is to be disciplined about following your budget. That means making tough choices when it comes to spending, even if it means saying no to things you really want. It’s also important to periodically reassess your budget and make adjustments as needed. Life changes and your finances should change with it.

Developing an Investment Strategy

It’s never too early to start thinking about your financial future. If you’re not sure where to start, developing an investment strategy is a great first step.

When it comes to investing, there are many different approaches you can take. The most important thing is to find an approach that fits your unique circumstances and goals.

One popular investment strategy is known as dollar-cost averaging. This approach involves investing a fixed amount of money into security or securities at regular intervals. Over time, this can help to smooth out the ups and downs of the market and reduce your overall risk.

Another strategy that you may want to consider is known as value investing. This approach looks for stocks that are undervalued by the market and have the potential to generate strong returns over the long term.

There are many other strategies out there as well, so be sure to do your research and find one that best suits your needs. With a little effort and planning, you can put yourself on the path to a bright financial future.

Saving Money for Emergencies

When it comes to saving money, it’s important to have a plan for both short-term and long-term savings goals. While it’s important to save for retirement, you also need to be prepared for unexpected expenses that can pop up at any time.

One of the best ways to do this is to create a separate savings account that you only use for emergencies. That way, you’re less likely to dip into it for non-essential purchases. You should aim to have at least three to six months of living expenses saved in this account so that you’re covered if you lose your job or have another major financial setback.

Building up your Emergency fund can take time, but there are a few things you can do to speed up the process. First, make sure you’re automatically transferring a fixed percentage of your paycheck into your savings account each month. This will help you stay disciplined with your saving goals.

You can also look for ways to cut back on your spending so that you have more money available to put into savings. For example, if you know you tend to overspend when you go out to eat, try cooking at home more often or packing your lunch instead of buying it. Every little bit helps when it comes to growing your emergency fund.

Paying Off Debt

If you’re like most people, you probably have some debt that you’re trying to pay off. Whether it’s a mortgage, a car loan, credit card debt, or student loans, debt can be a major burden.

There are a few different approaches you can take to pay off your debt. You can try to pay off the debts with the highest interest rates first, or you can focus on paying off the smallest debts first. Whichever approach you choose, the goal is to get rid of your debt as quickly as possible.

One way to speed up the process of paying off your debt is to make extra payments each month. Even an extra $50 or $100 can make a big difference over time. Another option is to consolidate your debts into one loan with a lower interest rate. This can help save you money on interest charges and make it easier to keep track of your payments.

Whatever approach you take, remember that it’s important to stay disciplined and focused on your goal of becoming debt-free. With perseverance and a little bit of planning, you can get ahead financially and achieve your financial goals.

Finding New Sources of Income

There are many ways to get ahead financially, but one of the best ways is to find new sources of income. There are a lot of ways to do this, but some of the best include starting a side hustle, investing in real estate, or becoming a digital nomad.

Starting a side hustle is a great way to make extra money and get ahead financially. There are many different types of side hustles you can start, so find one that fits your skills and interests. Once you get started, be sure to promote your side hustle and get the word out there.

Investing in real estate is another great way to get ahead financially. Real estate can be a great investment because it tends to appreciate over time and can provide you with a steady stream of income. If you’re not interested in being a landlord, you can also invest in REITs or real estate crowdfunding platforms.

Becoming a digital nomad is another great option for getting ahead financially. As a digital nomad, you can work from anywhere in the world and often have more freedom and flexibility than traditional employees. Plus, digital nomads often have lower living expenses since they don’t have to pay for things like rent or utilities.

Automating Savings and Investments

If you want to get ahead financially, one of the best things you can do is automate your savings and investments. By setting up automatic transfers into your savings and investment accounts, you’ll ensure that you’re always putting money away for the future. This will help you reach your financial goals much faster than if you were manually transferring funds each month.

There are a few different ways to automate your savings and investments. One option is to set up automatic transfers from your checking account to your savings and investment accounts. You can also set up automatic deductions from your paychecks so that a certain amount of money is always going into your savings and investment accounts.

Whatever method you choose, make sure that you’re automatically transferring enough money each month to reach your financial goals. Automating your savings and investments is one of the smartest things you can do to get ahead financially.

Making Smart Decisions

Making smart decisions with your money is one of the most important things you can do to get ahead financially. There are a few simple things you can do to make sure you’re making the best possible decisions with your money.

First, always pay yourself first. This means that before you spend any money on bills or other expenses, you should put some money into savings. This will help you build up an emergency fund so that you’re not left scrambling if something unexpected comes up.

Second, invest in yourself. This means taking the time to learn about personal finance and investing. The more you know about managing your money, the better off you’ll be. There are plenty of resources out there to help you learn more about personal finance, so take advantage of them.

Third, make a budget and stick to it. This may seem like a no-brainer, but it’s amazing how many people don’t have a budget. If you don’t know where your money is going, it’s very difficult to save. sit down and figure out what your regular expenses are and then track your spending for a month or two to get an idea of where your money goes.

Once you have a good understanding of where your money goes, you can start making changes to ensure that you’re spending within your means.

Conclusion

In this article, we discussed how to get ahead financially. It all starts with having a clear understanding of your finances and making smart decisions that will help you reach your financial goals.

The key is to create a budget, invest in yourself, take advantage of tax deductions, reduce your debt, save for the future, and look for creative ways to make money. With these strategies in mind, you can start taking steps toward achieving financial freedom.